What are ESR Notification and Reporting Requirements in UAE?

The Economic Substance Regulations (ESR) were introduced in the United Arab Emirates (UAE) in 2019 to comply with the Base Erosion and Profit Shifting (BEPS) initiative of the Organization for Economic Co-operation and Development (OECD). The ESR requires businesses engaged in certain relevant activities to demonstrate sufficient economic substance within the UAE. To ensure compliance, businesses must understand the ESR notification and reporting requirements. In this article, we will discuss the ESR notification and reporting requirements in UAE. You can consult Economic Substance Regulation experts also.

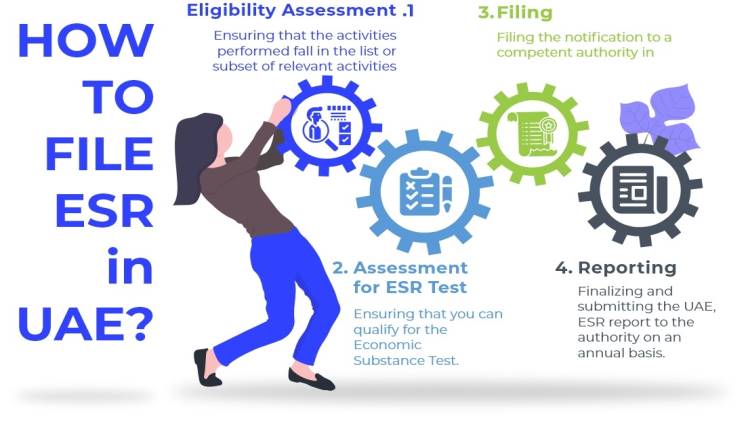

ESR Notification Requirements UAE

Under the Economic Substance Regulations, all UAE onshore and free zone companies that conduct Relevant Activities are required to submit a Notification to the Regulatory Authority. The Notification must be submitted within six months from the end of the company’s financial year. The Notification must include the following information:

- Name, legal form and identification number (commercial registration/establishment card number) of the entity.

- Contact details of the main officials like directors, partners or managers.

- Jurisdiction of incorporation or establishment if different from UAE.

- Description of the Relevant Activity being carried out.

- Confirmation on whether the entity generated Relevant Income during the Financial Year.

- Start and end dates of the Financial Year for the notification.

Exempted Licensees are also required to submit a Notification to the Regulatory Authority. Exempted Licensees are companies that are owned by the UAE government, or are wholly owned by UAE residents and are not part of a multinational group.

ESR Reporting Requirements UAE

In addition to the Notification, companies that conduct Relevant Activities are required to submit an Economic Substance Report (ESR) to the Regulatory Authority. The ESR must be submitted within 12 months from the end of the company’s financial year. The ESR must include the following information:

- Detailed income and expenditure statement with notes on sources of Relevant Income.

- Assets schedule specifying location, ownership and use of assets for the Relevant Activity.

- Employee information sheet containing names, roles, qualifications, days present in UAE.

- Description of Core Income Generating Activities conducted and management of risks.

- Minutes of board meetings/partner resolutions showing UAE management and control.

- Outsourcing agreements if applicable along with details of activities, employees, assets outsourced.

- Location and description of business premises maintained in UAE.

- Any other relevant information requested by the Regulatory Authority or National Assessing Authority.

Exempted Licensees are not required to submit an ESR report, but they must retain all relevant documents, records, and information required to meet their obligations under the ESR Regulations for a period of six years from the end of their financial year.

Regulatory Authorities and National Assessing Authority

The UAE Cabinet of Ministers has appointed various authorities to oversee the implementation, monitoring, and enforcement of the ESR Regulations UAE in respect of each Relevant Activity. The Federal Tax Authority has been appointed as the National Assessing Authority. The functions of the Regulatory Authorities are set out under Article 4 of the ESR Regulations UAE. These functions include, inter alia, the following:

- Collecting Notifications and Economic Substance Reports from Licensees and Exempted Licensees

- Collecting all relevant information as required to be submitted by such entities

- Reviewing Notifications, Economic Substance Reports, and any information attached thereto for accuracy and completeness

- Reporting information to the National Assessing Authority and/or Competent Authority

- Carrying out any other functions for the purposes of implementing the provisions of the ESR Regulations UAE

Penalties for Non-Compliance

Failure to submit the required notification on time may result in administrative penalties of AED 20,000 imposed by the FTA.The penalties aim to encourage timely compliance with ESR notification obligations. Failure to submit a complete and accurate report or meet economic substance requirements may result in penalties of AED 50,000. Licensees must maintain documentation to support their report.

In conclusion, the ESR notification and reporting requirements in UAE are an important aspect of the ESR Regulations UAE. Companies that conduct Relevant Activities in the UAE must ensure that they comply with the ESR Regulations by submitting ESR Notifications and Economic Substance Reports to the Regulatory Authority. Seeking the guidance of ESR consultants in UAE can help companies to comply with the ESR Regulations UAE and avoid penalties for non-compliance.