4 days ago

Factors to Consider Before Hiring a Workers Compensation Attorney?

In the field of business-to-business (B2B) transactions, securing the right legal support is crucial, especially when it comes to matters…

6 days ago

By the River: Peaceful Fishing Moments

Utah’s vast and varied waterways offer a serene escape for anglers seeking tranquility and a connection with nature. Fishing is…

1 week ago

Taiwan Earthquake Response: Lessons Learned from Recent Events

Taiwan, located on the Pacific “Ring of Fire,” is a hotspot for seismic activity, experiencing frequent earthquakes that shape its…

2 weeks ago

Polka Dots Necktie for Weddings: Adding Whimsy to Your Big Day

Weddings are a celebration of love, a day when every detail contributes to the magic and uniqueness of the occasion.…

2 weeks ago

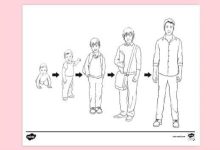

The Influence of Coloring Pages on Urdu Children’s Development at Different Age Stages

Coloring pages are more than just a pastime for children; they are a tool that can significantly influence cognitive, emotional,…

3 weeks ago

Why Did Champagne Ties Become Popular?

In the world of fashion, particularly in men’s formal wear, the emergence of the champagne tie has been nothing short…

3 weeks ago

Embracing Elegance: Exploring Trends in Concealed Door Design

Concealed doors have emerged as a hallmark of modern interior design, seamlessly blending functionality with aesthetics. As the demand for…

3 weeks ago

Why Is Mass Texting Essential for Event Promotions?

In event promotion, the old adage “out of sight, out of mind” couldn’t ring truer. With many events vying for…

3 weeks ago

Optimising Content for Virtual Assistants – The Key to Unlocking Efficiency

In the competitive and fast-paced digital landscape of today, virtual assistants have evolved into important tools for enhancing productivity and…

3 weeks ago

The Complete Breakdown of Demat Account Charges: Tips for Investors

Demat accounts have become an essential tool for investors in today’s digital age. These electronic accounts provide a secure and…